High Expectations: Managing For Value In The Automotive Industry

Chief Executive

NOVEMBER 15, 2022

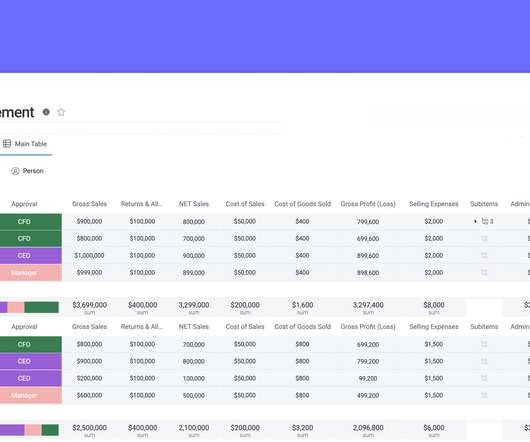

Since shareholder value is driven by investor expectations of future cash flow and EP growth (See S&P 500 Warranted Value of Discounted Economic Profits vs. Actual Traded Value chart, below), EP has been used as the profitability metric for AlixPartners’ Automotive Value Creation study.

Let's personalize your content