It’s Time For Leaders To Rethink The Way Their Companies Make Capital Expenditures

Chief Executive

JULY 26, 2022

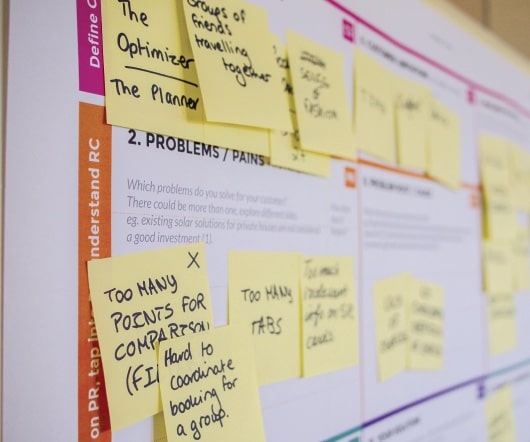

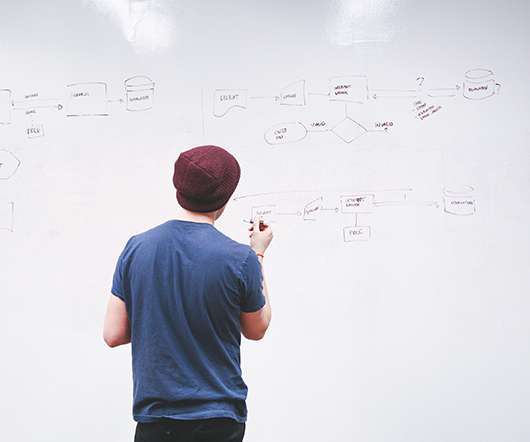

Instead, when a given site or plant makes a capex request, that request is judged only in terms of the anticipated change in cash flow of making—or not making—the investment in isolation. These teams must include experts from engineering, supply chain management, raw material procurement, controlling, marketing and sales.

Let's personalize your content