Navigate Risk with Intelligent Banking Operations

Accenture: OrgDev

NOVEMBER 7, 2021

Accenture describes how forward-thinking banks are focusing on three things to ensure intelligent banking operations are ready to face any risk. Read more.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accenture: OrgDev

NOVEMBER 7, 2021

Accenture describes how forward-thinking banks are focusing on three things to ensure intelligent banking operations are ready to face any risk. Read more.

Accenture: OrgDev

DECEMBER 14, 2021

For banking operations success, it's imperative to embrace AI and find the right mix of talent and technology.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AIHR

JANUARY 7, 2019

We did find that the number of bank tellers, number of training hours per employee, and the number of people promoted per branch didn’t lead to superior performance. The correlation between GMA and operating income of the branch was 0.49! We found that as the GMA of the branch managers increases operating income tend to increase.

Accenture: OrgDev

NOVEMBER 7, 2021

Accenture describes how forward-thinking banks are focusing on three things to ensure intelligent banking operations are ready to face any risk. Read more.

Accenture: OrgDev

DECEMBER 14, 2021

For banking operations success, it's imperative to embrace AI and find the right mix of talent and technology.

SME Strategy

MARCH 29, 2023

There are so many things to consider: The field your company operates in, and how quickly it changes, affects the complexity, length, and scope of your strategic plan. As a business leader, you know that creating and implementing an effective strategic plan can be overwhelming.

Growth Institute

JULY 27, 2022

Cash flow is the movement of money in all your business’s bank accounts during a given period or everything transferred in and out of your accounts. When you look at your bank accounts every week, month, and quarter, cash flow is the amount of money you’ve taken in compared with the last review. What Is Cash Flow?

Vantage Circle

JANUARY 2, 2025

Multi-Location Support: Simplify scheduling for businesses operating in multiple locations, ensuring consistency across all sites. Integration Capabilities: Seamlessly connect with payroll, HR, and time-tracking software to save time, reduce errors, and streamline operations. user/month Pro $5.99/user/month user/month Enterprise $10.99/user/month

Leadership Freak

JANUARY 5, 2018

While you can incorporate your business in pretty much any state you want to—even if you don’t intend to base your main operations there—it’s crucial that you choose the right state for your business’s needs. Select the state you want to incorporate your business in. Choose the type of corporation you want to organize as.

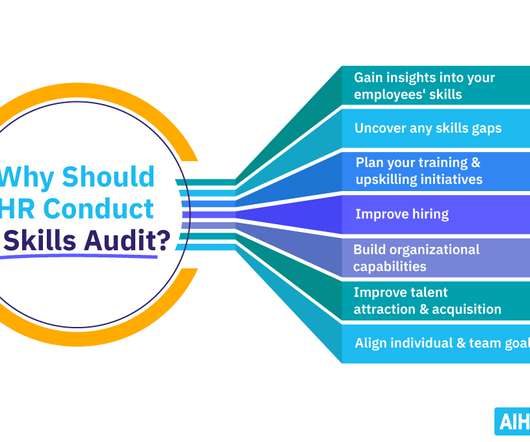

AIHR

OCTOBER 3, 2022

Consider a bank that is adopting a new technology that will replace the role of bank tellers. The bank teller skills will no longer be needed. However, the bank will need employees with technology skills in the future. A skills audit is also helpful when the company is changing, such as during restructuring.

Growth Institute

JULY 21, 2022

Think about building a better partnership with your bank. In my last article and during a recent webinar , I shared that cash flow is the movement of money in all your business’s bank accounts during a given period or everything transferred in and out of your accounts. Operating expenses. Think 2X profit, 3X cash, and 10X value.

UVA Darden

MARCH 20, 2023

The federal takeover has fueled fear among some that the failures are precursors to something akin to the Great Recession, when 450 banks failed between 2008 and 2012. Q: What led to the takeovers of Silicon Valley Bank in California and Signature Bank in New York? The bank also had long-dated assets.

AIHR

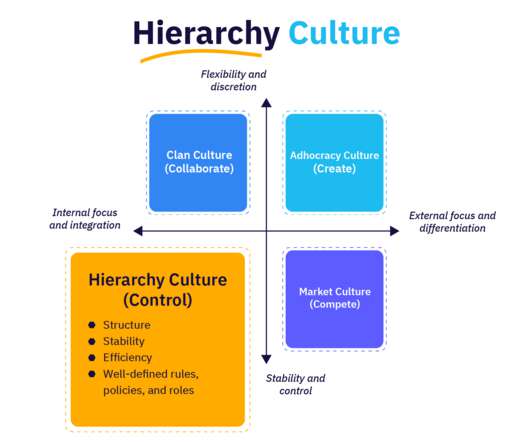

JULY 13, 2022

Companies in the financial, healthcare, and oil and gas industries often follow the hierarchical culture to manage risk, be more stable, and operate more efficiently. Like the military, financial institutions like investment banks operate in a strict and rigid hierarchy.

Chief Executive

NOVEMBER 21, 2022

No industry was more impacted than banking. When most of the nation’s bank branches closed for operations in March, 2020, the gradual, even glacial, shift from in-person to mobile banking exploded overnight by necessity—and it is never going back. No small task. In other words: Every CEO in every industry. .

Kotter Inc.

MARCH 28, 2023

The root cause of the collapse of Silicon Valley Bank continues to dominate headlines. In just the last two years there has been a worldwide pandemic, disruption in global supply chains, war in Ukraine, systemic labor shortage, runaway inflation, rising interest rates, a looming recession, and now a crisis of confidence in the banking system.

Chief Executive

APRIL 13, 2023

Are most companies prepared to operate effectively in a high interest rate economic environment over a long period of time? A few things boards might consider as interest rates reach their peak: What should boards do as banks tighten their lending to companies? The answers to these questions must be hashed out now.

Alison Green

AUGUST 18, 2022

I was so used to operating in a volatile, high-stress environment, I didn’t realize it didn’t have to be that way at work. It sounds simple, but when conflict is so engrained from childhood, you almost get addicted to the rush and it becomes a normal way to operate. To answer a few major points: (1) My bank is not a credit union. (2)

UVA Darden

MARCH 20, 2023

The federal takeover has fueled fear among some that the failures are precursors to something akin to the Great Recession, when 450 banks failed between 2008 and 2012. Q: What led to the takeovers of Silicon Valley Bank in California and Signature Bank in New York? The bank also had long-dated assets.

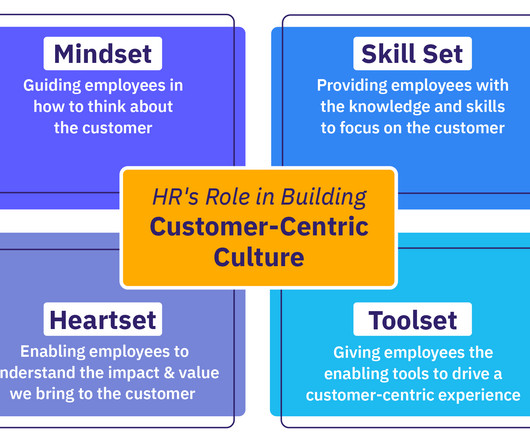

AIHR

MARCH 30, 2023

Customer-centric organizations often operate from an outside-in perspective, with each decision being informed by a deep understanding of the needs and desires of the customer. A product-centric organization operates from a more internally focused perspective with a clear focus on product features, benefits, and positioning.

Chief Executive

JUNE 20, 2023

And to make things worse, the crisis that took down Silicon Valley Bank and others has raised uncomfortable questions about the resiliency of the U.S. banking system. The twin specters of stubbornly high inflation and the rising cost of capital have added a degree of difficulty to doing business.

Chief Executive

JUNE 17, 2022

Although a similar closeness existed a decade ago, what is different in their relationship today is the CFO’s deeper involvement in operations. Our relationship has evolved to the point where I can’t imagine running the operations without her,” he said. I was initially an investment banker (at Deutsche Bank Securities).

AIHR

JANUARY 11, 2023

Labor costs like salaries, benefits, and related taxes make up as much as 70% of total operating costs of a business. Examples of liabilities are bank debts, taxes owed, and money owed to suppliers. Revenue is the total amount of income that a business generates from its primary operations. Why does HR need to know finance?

UVA Darden

JANUARY 6, 2023

Operations & Technology. Prior to his UVA appointments, he held positions at the University of Maryland as well as Johns Hopkins University, and he was a visiting scholar at Harvard University, the International Monetary Fund and the World Bank. The Economics of AI. Fri, 01/06/2023 - 09:52. 6 January 2023. Global Economies & Markets.

AlignOrg

FEBRUARY 7, 2025

In her current position since 2024, she contributes to the leadership of the firm, oversees commercial and sales operations, and maintains a connection to human resources functions. Prior to her tenure at AlignOrg Solutions, Dr. Ellis was the managing director at the Performance Lab from 2019 until 2021. Significantly contributing to Dr.

Chief Executive

MAY 1, 2023

airline ; the top-ranking airline in Fortune ’s World’s Most Admired Companies ; the most on-time global airline by FlightGlobal ; the Platinum Award recipient for operational excellence by Cirium ; among TIME100’s Most Influential Companies ; a Glassdoor Best Place to Work ; and more.

Chief Executive

NOVEMBER 16, 2022

Bank of America, Lombard Research, and many others project recession will be with us by the end of the year. Test the balance within your approach to Sales, Inventory, and Operations Planning (SIOP). SIOP often gets reduced to a business process with supporting tools/systems, but ultimately relies on the right operating model.

15Five

FEBRUARY 19, 2020

Education is a crucial way to achieve this mastery—learning new skills and practices and an understanding of how we all operate. Emotional Bank Accounts & Clearing Conversations. When the inevitable relational challenges do come up and you have to have a difficult conversation, you’ll have a bank account to draw upon.

Vantage Circle

MAY 19, 2022

An entrepreneur can use different tools to automate various business operations and check results from a single database. This feature-rich app helps with accounting, bank statements, and billing-invoicing and improves business intelligence. It is nearly impossible to take care of every detail manually.

AIHR

OCTOBER 18, 2022

A company operating in the insurance industry wanted to assess what drives the performance of sales agents in their business. The company’s operations in the two additional regional countries are relatively new and with a small staff. Contents Analyzing insurance sales agents’ performance Overall findings Recommendations.

Chief Executive

JUNE 28, 2023

In a time that many companies operate in a hybrid environment, and seldom are all together in person, it’s imperative to find ways to identify meaningful forms of kindness. Put an emphasis on good work in the communities where you operate. And kindness is a wonderful attribute to enhance business relationships. Find a common purpose.

AIHR

JULY 6, 2021

Over the last year, a multi-national bank decided to move towards a digital bank, and as a result, closed down all their bank branches. As a result, over 10,000 employees (bank tellers, receptionists, etc.) Employee retention rate = ((5000 – 2000 ) / 5000 ) x 100 = 60% employee retention. lost their jobs.

Chief Executive

MAY 18, 2023

Ironically, a healthy bank account can lead to emotional decisions when things go sideways. In good economies, the rule of thumb is to keep at least two months of operating expenses and payroll plus overhead on hand. If you’ve been operating at the same billable rate for the last decade, you’re not alone. Reevaluate your rates.

AIHR

FEBRUARY 1, 2023

An HR SWOT Analysis enables the HR team to gain a clear view of internal and external factors impacting your operations. Inadequate resources will limit its operation. Business operations are halted. A thorough analysis of strengths, weaknesses, opportunities, and threats will prepare you to create effective HR strategies.

Alison Green

OCTOBER 12, 2022

So, no matter what your position is (unless you’re an upper-level manager), you are at risk of being replaced and it only takes your manager opening the bank of applicants to move forward with replacing current employees. Why would anyone want to build a career somewhere that operates like that?

Vantage Circle

MAY 14, 2020

Banks, regulated industries, and many financial services companies did not encourage remote working. The daunting feeling of not knowing what the future holds or what measures to take to sustain organizational operations is a huge challenge. Managing Remote Work. The transition to remote work culture is not as seamless as it seems.

UVA Darden

MARCH 13, 2024

Ask for a Show of Hands burtonc Wed, 03/13/2024 - 12:13 12 March 2024 Leadership & Management Operations & Technology Modern Global Leadership Business & Public Policy Diversity, Equity and Inclusion Aine Doris The benefits of diversity in decision-making are well-documented. Decision by Committee?

Jackie Nagel

AUGUST 26, 2022

Did you know Microsoft keeps a year’s operating expenses in the bank? Not much happens without it. The larger your organization grows, the more critical money becomes to finance your growth. Cash flow, budget sheets, profit and loss statements, balance sheets — I can hear the wheels of your brain grind to a halt.

Michael McKinney

AUGUST 9, 2022

The highest performers in the study were operating at levels of efficiency and service that rivaled the best private-sector companies anywhere. If front-line ideas have so much potential to improve government operations, why do so many managers largely ignore them? Our revelatory finding? Navy, and The Washington Post.

Chief Executive

APRIL 5, 2023

Lingering uncertainties tied to supply chain disruptions, talent shortages, energy transition, war, the collapse of Silicon Valley and Signature Bank and the ongoing impacts of COVID-19 mean this slowdown looks nothing like the ones we’ve seen before. Align operational excellence with a customer focus.

Chief Executive

FEBRUARY 3, 2023

Although many business leaders are scrambling to keep their operations in the black, many still have roles to fill—and they’re increasingly expanding their contingent workforces to supplement their teams and increase their flexibility and financial agility. Of course, retention-related cost savings aren’t just from salaries.

Chief Executive

MARCH 21, 2023

Leave it to the CEO of WD-40 to find a way to smooth out any friction in his company’s culture, but that’s exactly what the company’s new boss Steve Brass did on day one of becoming the leader of a brand whose name has become synonymous with making things operate better. It’s about everybody in the organization.”

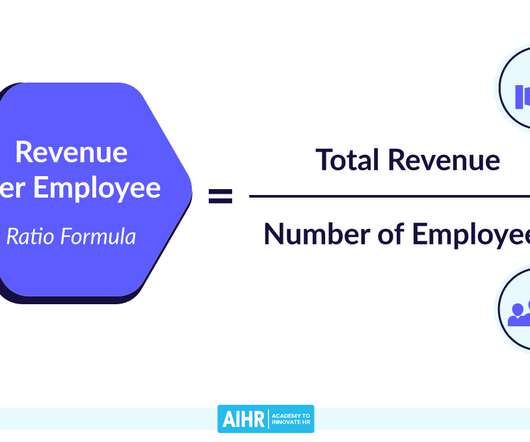

AIHR

NOVEMBER 9, 2021

Revenue per employee, of course, does not operate in a vacuum, and it’s essential to take into consideration both internal and external factors: Employee turnover – Revenue per employee can be affected by an organization’s turnover rate. Profit is the income that remains after all operating expenses, debts, etc.,

AIHR

SEPTEMBER 21, 2022

Your employees can start locally, such as helping out at community service projects or food banks, participating in a neighborhood clean-up, or supervising one’s child’s school trip. Volunteers can sign up to teach English or coding or to be a part of Paper Airplanes’ operational team. Examples of VTO. Be specific.

AIHR

JANUARY 23, 2019

Others – the people analytics leader or HR business partner manager – will be involved in delivering the day-to-day strategic and operational activities involved in using and implementing analytics, but without the support of the CHRO, this will all be more difficult. The CHRO is most often the buyer for people analytics.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content