Why LLCs Are A Great Vehicle For Asset Protection When Purchasing Real Estate

Forbes Leadership

JULY 22, 2022

In this article, I am going to share with you why LLCs are a great vehicle for asset protection when purchasing real estate.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Forbes Leadership

JULY 22, 2022

In this article, I am going to share with you why LLCs are a great vehicle for asset protection when purchasing real estate.

Michael McKinney

FEBRUARY 10, 2023

Sectors like construction, real estate, automotive manufacturing, financial services, and health care have been thought of as distinct categories, each operating in its own spheres. But that is changing. McKinsey partners Venkat Atluri and Miklós Dietz illuminate that change in The Ecosystem Economy.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Miss One Change, Face Major Risk: The New Compliance Crisis In HR And How To Fix It

The Hidden Skills That Separate Good Leaders from Great Ones

SME Strategy

JUNE 6, 2023

In this interview, we have the privilege of talking to Alastair Wood , Vice-President & General Counsel at Rhino , a New York-based real estate startup that aims to bring greater financial freedom to renters everywhere. How did you handle the situation, and what insights did you gain from it?

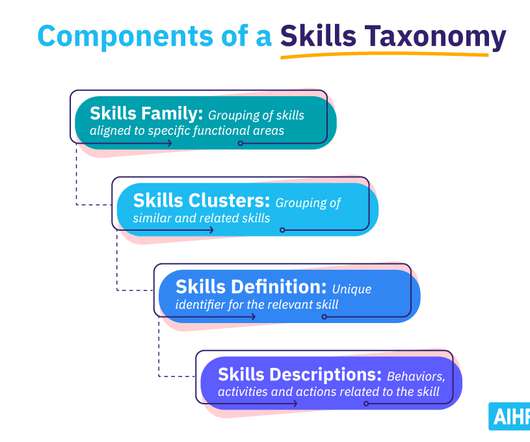

AIHR

AUGUST 3, 2022

Reduction in new real estate investment and freeze current expansion projects, yet maintenance of current footprint remains a priority. Do not renew current leases and consolidate real estate assets • Expand logistics capability and invest in additional skills and technologies. Property Development.

15Five

SEPTEMBER 3, 2020

When we appreciate these differences, we see them as assets that create stronger leaders, teams, and organizations. It’s actually one of our most precious assets during turmoil. .” Episode 29: Understanding Your Strengths To Build Stronger Teams. Here’s a bit of his wisdom from the episode: “Hope.

Chief Executive

APRIL 3, 2023

Today, our advisors are helping clients build and bolster their plans—strengthening emergency savings accounts, paying down high-interest debts, protecting the wealth they’ve already built and accumulating assets for the future. All told, we spent $14 billion to buy risk assets near market lows.

Forbes Leadership

JANUARY 25, 2023

Surplus office space, in fact, should be seen as an asset, not a liability. There are many practical uses of surplus office space. This is not a new challenge. Many others have been there before. Study what they did right, or wrong in some instances, and act accordingly.

Chief Executive

MARCH 21, 2023

Political risk insurance is a highly specialized form of insurance that protects a company’s assets, investments, or contractual rights in foreign countries from losses caused by political events happening abroad.

15Five

JULY 7, 2021

About the Customer: Birge & Held is a national, private equity real estate investment firm, headquartered in Indianapolis, Indiana. Since its inception in 2008, Birge & Held has acquired more than 12,000 units and has more than $1 billion in assets currently under management across the country.

Zenefits

APRIL 24, 2023

You can’t necessarily prevent lawsuits, but the right insurance policy can protect your business assets, your personal assets, and more. Real estate and bank contracts may require it If you rent or lease your office, warehouse, or other business facility, your agreement may require you to carry insurance.

Chris LoCutro

SEPTEMBER 12, 2023

So since everyone's situation is different, whether we're talking about a personal loan or a business loan, for real estate or to consolidate debt, there are a lot of factors to consider. And if you can't repay, they'll come for your home, your personal assets, whatever it is, because you might have that loan in your name.

Chief Executive

JUNE 17, 2022

“Even though we were still developing our relationship, I felt she had the skills and capabilities to partner with me from a vision perspective in transforming the finance organization from a support and compliance function into a business asset.”. It was hard and unpleasant. The tough decisions resulted in a resounding turnaround.

Alison Green

JANUARY 24, 2023

I can see their argument, as it’s a hugely useful asset in many ways (quickly becoming domain-ready, digging into complex research problems, getting through those 500 emails a day, etc.). I taught myself to read when I was two, and have been zooming through 200-300 books a year ever since. I retain content, I’m not just skimming.

Vantage Circle

AUGUST 13, 2019

Companies often forget about their most important asset- their employees. And its need is paramount in high-pressure jobs like real-estate and finance jobs. If you have a business, you understand the importance of customer experience. Sure, your customers drive your business. But who drives these customers towards your business?

Chief Executive

DECEMBER 1, 2022

The last couple of years were pretty good for business in the rebalancing after Covid, unless you were in commercial real estate,” says Stacy Kemp, executive lead of Deloitte’s CMO program. “Speeding up automation/digital transformation” registered second, with 32 percent. Hold Them Close.

Harvard Business Review

SEPTEMBER 29, 2016

At home, we’re Marie Kondo–ing our way to minimalism, buying experiences rather than things, and using services — Netflix, Spotify, Uber — rather than owning assets such as movies, music, and cars. In some cases, these assets are preventing companies from adapting, and weighing them down. For many years it was.

Chris LoCutro

JULY 11, 2023

What’s the most valuable asset to a business? Tangible or intangible assets. And while all of those things have substantial value, if they are “the most important” assets in our minds, then they will determine many of our business practices. How well do you take care of your most valuable asset? Your products or services.

Walk Me

MAY 23, 2023

Examples of Hybrid Work Schedules So – hybrid work is a very useful asset for your company. Additionally, the reliance on a central office space will keep real estate costs high – while reducing the geographical reach for new applicants. But there are many ways to implement hybrid work.

Vantage Circle

JANUARY 24, 2019

But companies often forget about their most important asset- their employees. And its need is paramount in high-pressure jobs like real-estate and finance jobs. If you have a business, you understand the importance of customer experience. Fortunately, they are now shifting the focus to employee experience.

Harvard Business Review

FEBRUARY 10, 2015

Credit Suisse and Brandeis University’s Institute on Assets and Social Policy took a closer look at that dataset to figure out whether there were similar disparities be found among the wealthiest households. Wealthy black Americans have more money in real estate holdings than equally wealthy white Americans.

Harvard Business Review

JULY 11, 2017

One of us is an urban theorist, the other a community-focused real estate developer. Here, real estate developers and managers can orient their tenant selection around companies that provide higher-paying, family-supporting jobs with pathways for upward mobility and careers. We think cities can do better.

Harvard Business Review

JUNE 8, 2012

A 30% drop in real estate prices, which systematically threatened all lenders with upwards of a trillion dollars of losses, caused the financial crisis. Because it takes time to repay loans, the economy runs the risk that short-term savers may panic and demand withdrawals en masse—when real estate prices fall 30%, for example.

AIHR

SEPTEMBER 12, 2021

With many employees working from home, some companies no longer have any money invested in real estate. HR looks out for literally the most important asset the company has. Most businesses spend more on their people than on anything else. It’s computers and people.

Harvard Business Review

AUGUST 28, 2017

And the risks are real: Zillow’s research predicts that $400 billion dollars of real estate value in Florida could be at risk from climate change by the year 2100. By investing in these durable improvements, real estate owners can lower their premiums because they have reduced the risk that their real estate assets face.

Harvard Business Review

JUNE 12, 2012

Just like Ireland, Spain had a credit boom financed mostly with external debt, which meant that the balance sheets of their banks are now stuffed with bad debts as asset values collapse. And yet in the run up to the collapse in 2007, the combined asset footprint of the three main Irish banks was around 400 percent of GDP.

Harvard Business Review

NOVEMBER 21, 2018

Higher-fee, actively managed funds lost $500 billion in assets since 2015, with much of it flowing to much lower cost passive funds (e.g. You can now invest in ‘fix and flip’ real estate investments via companies like Groundfloor, Lending Home, and PeerStreet. index funds).

Harvard Business Review

MARCH 15, 2018

We analyzed companies’ debt-to-equity ratio, equity ratio, risk buffer, property mortgage or the mortgage of the venture’s real estate ratio, the use of bank overdraft facilities/approved checking account ratio, and long-term liabilities or loans ratio. We then chose specific measures to evaluate each of the four beliefs.

Harvard Business Review

JANUARY 20, 2016

Asset owners and investors thus have clear information about the strong incentive to adapt to this emerging risk. Real estate investors will have strong incentives to respond to these forecasts. Self-interest is a powerful force nudging all asset owners—whatever their political affiliation—to adapt.

Harvard Business Review

JUNE 8, 2012

A 30% drop in real estate prices, which systematically threatened all lenders with upwards of a trillion dollars of losses, caused the financial crisis. Because it takes time to repay loans, the economy runs the risk that short-term savers may panic and demand withdrawals en masse—when real estate prices fall 30%, for example.

Harvard Business Review

APRIL 14, 2016

But this new report, by estimating the risk to all financial assets and portfolios, finds a powerful middle ground that should get investor attention. These so-called “stranded assets,” sitting on petro-company balance sheets, are essentially worthless. These time frames are not theoretical for long-term asset owners.

Harvard Business Review

SEPTEMBER 12, 2012

The International Reciprocal Trade Association reports that in 2011 over 400,000 companies worldwide used bartering to earn an estimated $12 billion on unwanted or underused assets. Lufthansa has bartered real estate for media credits and aviation fuel. What other assets could you benefit from bartering?

Harvard Business Review

JUNE 6, 2014

It’s the bubble of bubbles: it not only mirrors the previous bubbles (whether of the Tulip, Silicon Valley or Real Estate variety), it undergirds them all. The asset we’re overvaluing now is the notion of doing it all, having it all, achieving it all; what Jim Collins calls “ the undisciplined pursuit of more.”.

Harvard Business Review

JUNE 19, 2017

When two companies merge, regardless of who technically acquires whom, their assets are bundled together and their capabilities can be remixed , much like how music tracks are combined to produce a new song. For all its troubles, Whole Foods still delivers higher returns on assets and sales than Amazon does.).

Harvard Business Review

FEBRUARY 29, 2012

That's why most investments in Africa are in mature industries like oil & gas, real estate, and finance, among others. Doing so positions you to legally tie your assets to highly-liquid funding environments, and your exit path will be expanded. So what can entrepreneurs in the developing world do?

Harvard Business Review

FEBRUARY 16, 2011

Of course, processes, people, organization, and assets must all be aligned so companies can deliver the customer value proposition efficiently. The average store size is smaller than that of rivals and investments in real estate, furniture, and décor are relatively low.

Harvard Business Review

JULY 29, 2014

Sarah, an experienced real estate consultant, had always been happy to help. Even though we’ve had a steady rise in our stock price, we’ve been relying more and more on purchasing underperforming assets using floating-rate debt. It’s that board I’m on — the real estate company.” It didn’t help that J.P.’s

Harvard Business Review

SEPTEMBER 23, 2014

Market participants imagine what will happen in the future and pay prices for securities — whether stocks, bonds or real estate investments — that reflect their beliefs about the future value of such securities. Before the price drop, I owned a set of assets. After the drop, I own the same assets. I am no poorer.

Harvard Business Review

APRIL 4, 2016

While they do leverage nontraditional assets (e.g., For example, many leading hotel companies moved to an “asset light” model years ago. Sponsored by Accenture. How online marketplaces are changing the face of business.

Harvard Business Review

MARCH 21, 2018

He tried tech, finance, and real estate — all to no avail. Through his work in real estate, where he’d spend hours each day driving, he started listening to podcasts, and eventually decided to start his own. .” But he’s no longer concerned.

Harvard Business Review

JUNE 10, 2014

Meanwhile, trustees control universities’ sometimes-giant endowments, and most often delegate this control to asset managers who treat the endowments as pools of money with the sole purpose of creating more money. The trustee committees and endowment managers are fine with making investment decisions about any old asset.

Harvard Business Review

JANUARY 11, 2016

The world is not short on capital — a startling $43 trillion of assets is currently under management in the United States alone. The main challenge is that investors are very good at understanding a single asset with standalone cash flows — a toll road, for example, or a power plant, or an apartment building.

Harvard Business Review

JULY 22, 2016

Network businesses have always been around, from matchmakers to real estate brokers, but it’s the move to digital platforms that has led to market-shaking effects. They begin with different values, invest in different assets, and choose different leaders. Difficult, but not impossible.

Harvard Business Review

APRIL 24, 2014

The Bitcoin protocol could simplify complex asset transfers, revolutionizing the services that support this industry. Currently, the transfer of large assets requires significant time and resources. Bitcoins can be qualified in such a way that they represent real-world assets. The blockchain could change all of this.

Harvard Business Review

APRIL 25, 2011

It's easier to meet Community Reinvestment Act targets with housing and real estate than with business loans. The banks have retreated from that business — pursuing economies of scale, rather than helping scale up small companies. America's great foundations, with $600 billion to invest, invest it much as they always have.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content