Why Is Cash Flow Important To Survive In Our Tough Business Climate?

Growth Institute

JULY 27, 2022

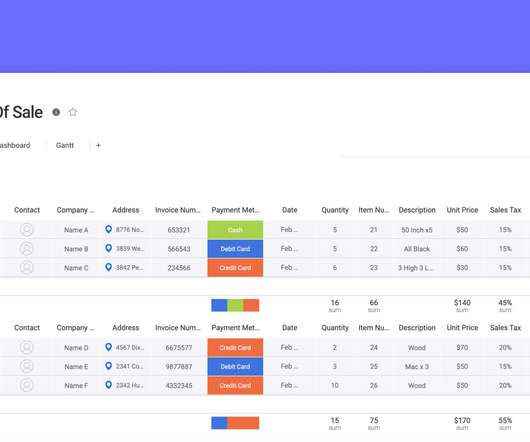

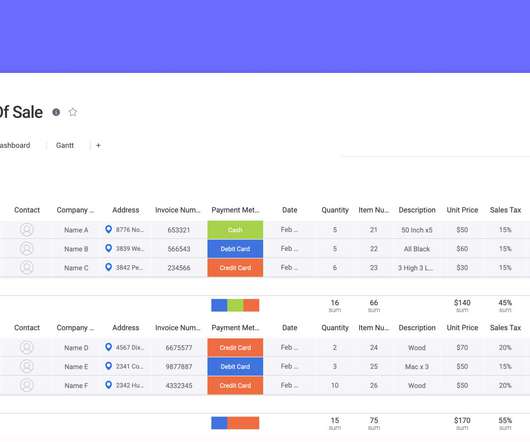

Cash flow is the movement of money in all your business’s bank accounts during a given period or everything transferred in and out of your accounts. When you look at your bank accounts every week, month, and quarter, cash flow is the amount of money you’ve taken in compared with the last review. What Is Cash Flow?

Let's personalize your content