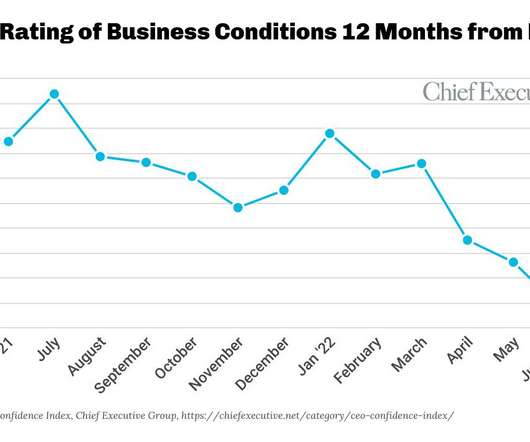

CEO Confidence Falls To Decade Low, But Few Predict Recession

Chief Executive

JUNE 13, 2022

It is the lowest level it’s been since January 2013, on the heels of the “Fiscal Cliff” drama in Washington and ahead of further debt ceiling negotiations. . CEOs say it’s the uncertainty of the situation more than specific issues that is driving their forecast down, although the list of concerns they shared continues to grow each month. “The

Let's personalize your content