Cash Flow Tips To Keep Your Small Business Afloat

Forbes Leadership

MARCH 21, 2023

Cash flow management is essential for the financial health of every small business.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Forbes Leadership

MARCH 21, 2023

Cash flow management is essential for the financial health of every small business.

Zenefits

DECEMBER 26, 2022

To help small businesses and HR managers figure out how to navigate accommodations, we’ve created this brief guide and checklist. Is your business eligible for reasonable accommodation mandates? Your organization’s cash flow, size, net cost, access to government resources, or even potential tax credits are all considered.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Miss One Change, Face Major Risk: The New Compliance Crisis In HR And How To Fix It

The Hidden Skills That Separate Good Leaders from Great Ones

SME Strategy

APRIL 13, 2023

How do you valuate a small business?

Forbes Leadership

APRIL 19, 2023

Not only can it help you keep track of your cash flow and expenses, but it can also help you make profitable decisions for your business.

Chris LoCutro

JULY 17, 2024

Step 2: Crunch the Numbers Let’s talk numbers—ensure any risk you’re considering is one your business can shoulder financially. Use forecasting to play out different scenarios and see how they might affect your cash flow. Step 3: Test the Waters Consider starting small. It’s like having a financial crystal ball!

Zenefits

JUNE 29, 2022

With tight cash flow and an uncertain market, small businesses can be financially ruined by a disastrous, unexpected lawsuit or accident. In fact, 43% of business owners are threatened with or have been involved in a lawsuit, and litigation can easily cost up to $150,000. What insurance does a small business need?

Zenefits

AUGUST 3, 2022

Small business owners have a lot on their plate. But who can a business owner speak with for advice on business strategy? Another business owner may have some advice, but do they have the industry-specific experience to answer all your questions? What does a business consultant do for companies? Operations.

Chris LoCutro

JUNE 5, 2024

Why Do So Many Small Businesses Fail? An In-Depth Look Starting a small business is a dream for many, fueled by desires for independence, passion, and personal fulfillment. Cash Flow Management One of the most cited reasons for small business failures is poor cash flow management.

Chris LoCutro

JUNE 5, 2024

Why Do So Many Small Businesses Fail? An In-Depth Look Starting a small business is a dream for many, fueled by desires for independence, passion, and personal fulfillment. Cash Flow Management One of the most cited reasons for small business failures is poor cash flow management.

Zenefits

JANUARY 20, 2023

If your business is growing, it’s time to start hiring help. For small businesses just starting out, it’s often more cost-efficient to bring on independent contractors to complete smaller jobs or help out with things like marketing and sales.

Zenefits

JUNE 1, 2022

With the rising inflation rate breaking all records, rising interest rates, supply chain disruption, the ongoing pandemic, and armed conflict in Europe, small businesses are caught between a rock and a hard place. There are a number of actions a small business owner can take to reduce the effect of inflation on their organization.

Harvard Business Review

MAY 25, 2022

They could reduce payment processing costs and cash flow issues.

Zenefits

DECEMBER 29, 2022

At this stage, a business has just opened its doors, or it’s growing rapidly. Generally, the economy is good, debt is low or paid on time, and cash flow accumulates. Even small business owners can struggle to diagnose where they are in the business cycle — until it’s too late.

Zenefits

NOVEMBER 1, 2022

Is yours an established business or a startup with?cash business loan?to working capital so you can meet your daily business obligations. business loan?options business owners. business lines? small business loan , you may be confused about how many and what kinds of loans are available.

Chris LoCutro

APRIL 23, 2024

In this episode of The Chris LoCurto Show, we dive deep into the delicate process of second-generation transitions in small businesses. If they've never been in the P&Ls, if they've never understood the budgeting, the forecasting, if they've never understood what assets you have, what that looks like, cash flow.

Harvard Business Review

SEPTEMBER 16, 2014

And limited credit is in part caused by the difficulty of predicting which small businesses will and won’t succeed. In the past, a community bank would have a relationship with the businesses on Main Street, and when it came time for a loan, there would be a wealth of informal information to augment the loan application.

Zenefits

MAY 15, 2023

In addition, an organized, transparent payroll process helps the company function efficiently and understand its cash flow more comprehensively. Access to accurate information helps businesses at tax time Staying ahead of federal income tax demands is a smart business move.

Zenefits

DECEMBER 4, 2022

You can still claim an employee retention credit (ERC) if you own a small business and had to partially or fully close because of COVID-19. Your business can claim a maximum credit of 50% of the wages paid to staff in 2020 and 70% in 2021. And, of course, having organized payroll software can help you stay on track.

Zenefits

SEPTEMBER 7, 2022

One of the 1st considerations all HR managers and small business owners need to consider is the limitations of remote work. Businesses were concerned about cash flow and immediate solutions to lockdowns. And to get started, we need to answer 1 important question: What does your organization mean by “remote work?”.

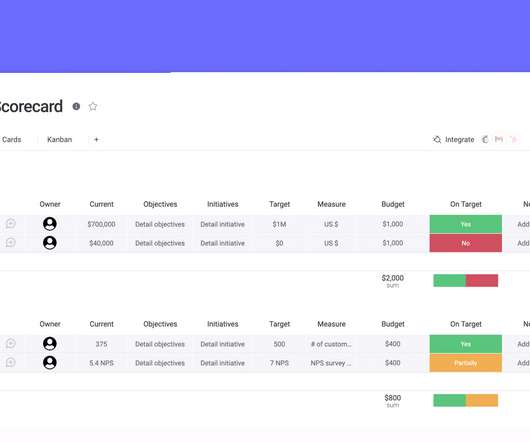

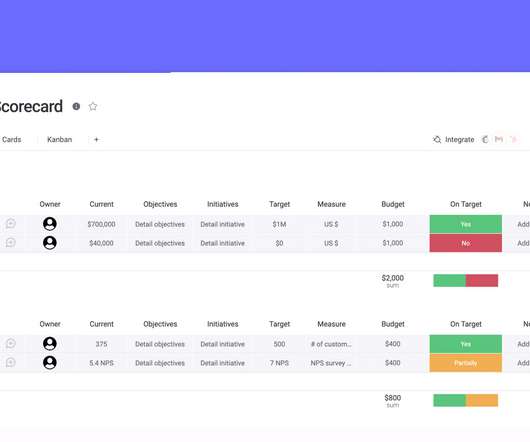

Monday Task Management

MARCH 15, 2022

Larger organizations might require more detail — and of course, it depends quite a bit on the preferences of the executives for whom you’re preparing the BSC — but small businesses and startups can generally get away with something relatively simple. For example, the financial metrics this business is tracking are: ROI.

Monday Task Management

MARCH 15, 2022

Larger organizations might require more detail — and of course, it depends quite a bit on the preferences of the executives for whom you’re preparing the BSC — but small businesses and startups can generally get away with something relatively simple. For example, the financial metrics this business is tracking are: ROI.

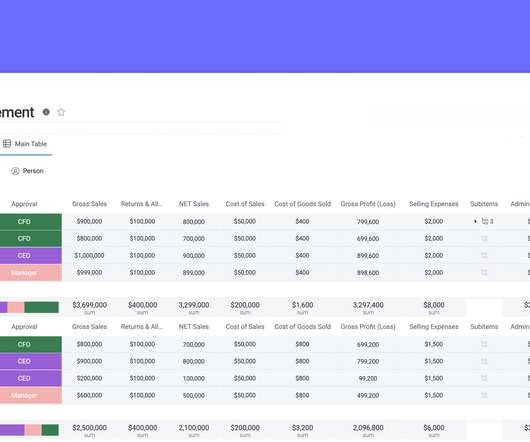

Monday Task Management

MARCH 15, 2022

You can then customize those rows and drop in your own data to quickly create a suitable P&L statement for your business. If you’re wearing a dozen different hats for your small business or don’t have a full-time accountant to devote to this task, it can be tricky getting started — and time-consuming once you get going.

Harvard Business Review

JUNE 28, 2016

Owners of small businesses can set their own hours, make their own management decisions, and take pride in the ownership of their work. So, the remaining question about being a small firm CEO is the monetary reward; if the money is nearly the same, then the compensation as a small business CEO dominates other careers.

Harvard Business Review

NOVEMBER 23, 2010

His business had collapsed. He started very well, but as soon as his cash flow improved, financial burdens from family systems stifled his operations. As more people depended on him, he spent his working capital, and the business failed. Rather, they were abandoning their businesses because of bad bookkeeping.

Chris LoCutro

MARCH 5, 2024

And that is this whole idea of this quiet battle that leaders go through especially small business owners, and that is this whole thing of being isolated, and feeling isolated. And you're sitting there, maybe you're in an unhealthy place cashflow wise, within your business. I'm feeling all this stress.

Harvard Business Review

NOVEMBER 23, 2010

His business had collapsed. He started very well, but as soon as his cash flow improved, financial burdens from family systems stifled his operations. As more people depended on him, he spent his working capital, and the business failed. Rather, they were abandoning their businesses because of bad bookkeeping.

Harvard Business Review

SEPTEMBER 16, 2014

And limited credit is in part caused by the difficulty of predicting which small businesses will and won’t succeed. In the past, a community bank would have a relationship with the businesses on Main Street, and when it came time for a loan, there would be a wealth of informal information to augment the loan application.

Harvard Business Review

JULY 13, 2015

If your small business owes $2,736 to debtors and has $2,457 in shareholder equity, the debt-to-equity ratio is: (Note that the ratio isn’t usually expressed as a percentage.). They want to know, says Knight, “Does the company have the ability to develop revenue, profit, and cash flow to cover expenses?”

Harvard Business Review

MARCH 23, 2015

Most finance managers in both large and small businesses encounter numerous proposals for capital investments and many of the people proposing these investments don’t have a clear picture of what the return will be. To get the green light, it helps to understand how finance people think. Of course not.

Chris LoCutro

SEPTEMBER 12, 2023

This business is teaching you a lot of my mistakes, a lot of the dumb that I've done, right of having made stupid decisions, having put myself in bad situations, and leveraging myself in bad ways. So when you walk into a bank asking for money for your small business, who are they going to ask for a signature?

Harvard Business Review

APRIL 26, 2017

Lending to small and medium-sized businesses is ready to move online. Small businesses are starting to demand banking services that have engaging web and mobile user experiences, on par with the technologies they use in their personal lives. The problem is that about 60% of small businesses want loans below $100,000.

Harvard Business Review

NOVEMBER 23, 2016

Small businesses and young businesses are especially vulnerable. Census Bureau shows that these businesses were more likely than the average business to close permanently after Hurricane Katrina, for example. Second, young businesses tend to grow faster than older ones, but also fail at greater rates.

Harvard Business Review

MAY 1, 2012

As an entrepreneur or small business owner, nothing can strike terror into your heart like the arrival of a fat envelope containing what you know to be the latest invoice from your law firm. You don't have to resign yourself to sickening surprises or invoices that destroy your cash flow projections.

Chris LoCutro

JANUARY 30, 2024

It's like I was saying, when you don't understand what your capacity is, to accomplish the goal that you're setting when you don't understand, and I'm talking about everywhere, team members, money, cash flow, tools, footprint, right? So for a small business, we might be able to grow 40 to 60%. And we do just fine.

Harvard Business Review

JANUARY 10, 2013

But like the terms "strategy" and "business model," the word "entrepreneurship" is elastic. For some, it refers to venture capital-backed startups and their kin; for others, to any small business. For some, "corporate entrepreneurship" is a rallying cry; for others, an oxymoron.

Harvard Business Review

JANUARY 22, 2016

My older daughter, Heather, ran a scrapbooking business, hosting classes where people came and learned to create customized scrapbooks, and selling related supplies, too. She also ran another small business, digitizing old photos and then editing the digital copies to make them look better.

Harvard Business Review

FEBRUARY 2, 2015

Payment startups like Square and cash-flow management startups like Pulse App also capture transaction data that can help them map out commercial graphs for small businesses. LinkedIn’s Sales Navigator shows the company’s intent to move beyond connecting professionals to connecting companies.

Harvard Business Review

SEPTEMBER 12, 2013

Community financing refers to a form of cash-flow that channels the financial resources of the savers of a community into the well-being of that community via economic activities, which members of the community believe should be undertaken and therefore willingly supports with their savings. It is something I call community financing.

Harvard Business Review

SEPTEMBER 2, 2015

You need to understand the two or three that drive your organization’s profitability and cash flow.” Try to understand all of the data available to you—select the two or three metrics that drive your company’s cash flow and profitability and concentrate on those. That’s too many.

Harvard Business Review

JUNE 10, 2015

The basic point was that online advertising was too small, and that transaction sizes were too insignificant to be anything other than a step down for companies used to rich cash flows. But there is nothing inherently wrong with digital pennies, if you have the right business model.

Harvard Business Review

MARCH 31, 2015

bank in assets, JP Morgan Chase , announced that in August, hackers had accessed its security system and that approximately seven million small businesses and 76 million households had been affected by a data breach. In the beginning of October, 2014, the largest U.S.

Harvard Business Review

MARCH 26, 2015

CROs can increase market share among underserved customers, such as small business owners and the “unbanked” (i.e., those without bank accounts), by adopting the more dynamic “customer life cycle” view.

Peter Winick

NOVEMBER 14, 2022

You’re going to, you know, in the case of onramp, you’re going to help more small business owners be sustainable and reach escape velocity with your working capital solutions. The accountants have intel of small businesses use QuickBooks. The accountant and says to the small business owner use QuickBooks.

Harvard Business Review

SEPTEMBER 14, 2017

Research shows that abnormal weather disrupts the operating and financial performance of 70% of businesses worldwide. When weather conditions are on average adverse over days, weeks, or entire seasons, shortfalls in sales cause reduced cash flows and can lead to financial distress and business failure. alone, or 3.5%

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content