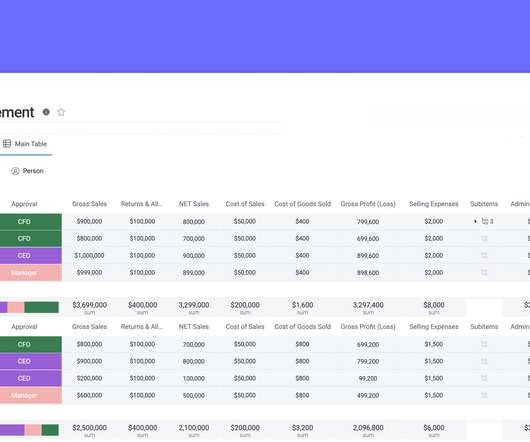

Customizable profit and loss template for SMBs

Monday Task Management

MARCH 15, 2022

A basic break-even analysis template should include customizable fields where you can input all the variable costs of your new venture — including fixed costs, price, volume, and other factors that could ultimately affect your net profit. This helps you figure out when you’ll break even. Image Source ). Unlimited automations.

Let's personalize your content