Managing The Crisis: A Brief Guide On Crisis Management

Vantage Circle

MAY 2, 2019

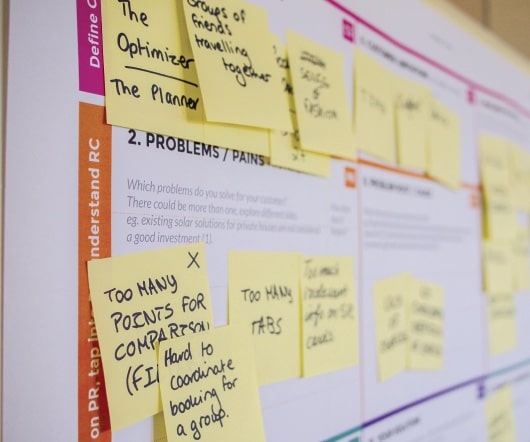

What Is Crisis Management? In a nutshell, crisis management or risk management is the series of actions taken by a company during the event of a crisis. Lehman Brothers were one of the world’s largest investment bank with a history of 163 years. Drop-in sales figures. Take a look at Lehman Brothers.

Let's personalize your content