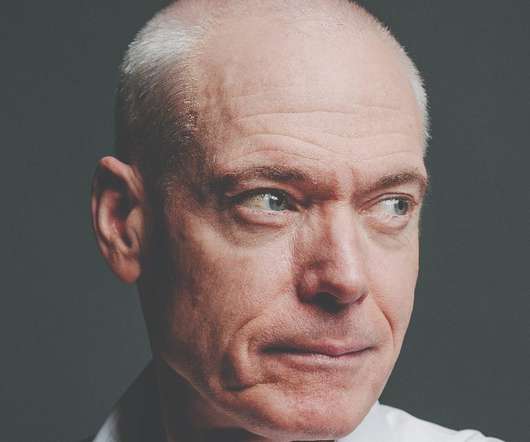

Exclusive: Jim Collins on ‘Thriving In Chaos’

Chief Executive

JULY 25, 2022

But they had this march, which was doubling components at affordable cost every 18 to 24 months, no matter what, like clockwork. It speaks to figuring out what that one key metric is that moves your business, and committing to it over and over. And if we do that, we can’t help but grow revenues per fixed cost.

Let's personalize your content