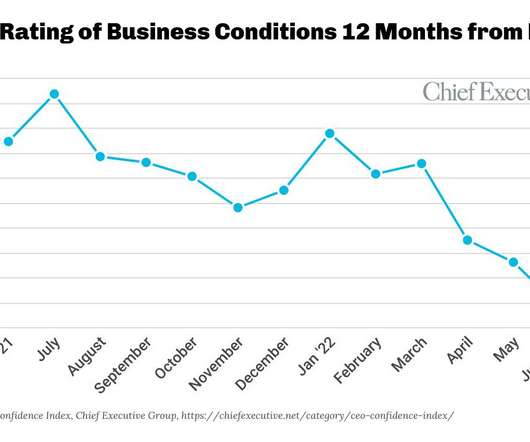

CEO Confidence Falls To Decade Low, But Few Predict Recession

Chief Executive

JUNE 13, 2022

We will not build sustainable growth without affordable energy, a motivated workforce and an efficient supply chain.” The Year Ahead The proportion of CEOs forecasting increases in profits and revenues over the coming year continued to fall in June, now down 21 and 10 percent respectively.

Let's personalize your content