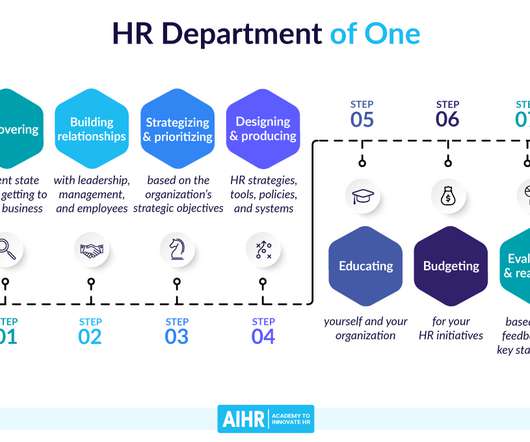

HR Department of One: How to Succeed

AIHR

FEBRUARY 14, 2022

However, if you are expected to build the HR department from the ground up, you will need to withdraw from your bank of HR competencies and organizational and interpersonal skills to be successful. Compliance may be the most compelling reason to hire an HR professional. It may include conducting a compliance audit to determine gaps.

Let's personalize your content