How To Calculate Total Compensation

Zenefits

FEBRUARY 3, 2023

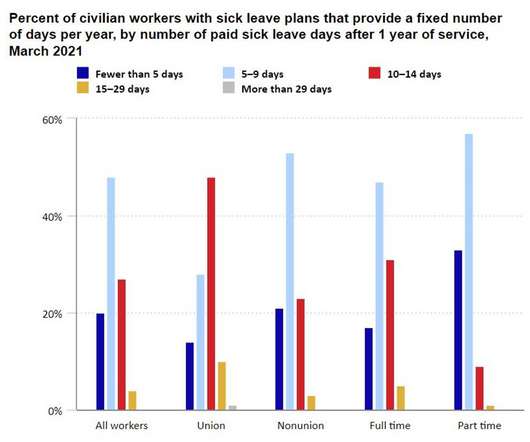

Sometimes an employee’s salary only accounts for a portion of everything they make. Base salary or wages Base pay accounts for the majority of most employees’ compensation. For hourly employees, the number of hours worked should be accounted for. Health reimbursement account ( HSA ). Calculate a weekly pay.

Let's personalize your content